127081, Moscow, Molodtsova Str, 29, Bld. 2

Phone: +7 (495) 409-0869| Mail: request@windsofchange.ru

Professional marketing research

Due to the current economic situation and limitation of certain goods import from countries standing for sanctions against Russia (members of EU, USA, Canada, Australia, etc.), domestic agricultural producers are provided with new opportunities and number of important tasks need to be solved.

An extension of cooperation with members of the CIS, countries of Eastern Europe, Asia and Africa in the short term and the long-term plan for reconstruction and development of the local agriculture implementation - these are the obvious ways to compensate the previous food products import volumes. To date, the economic performance of the domestic agricultural sector is quite low.

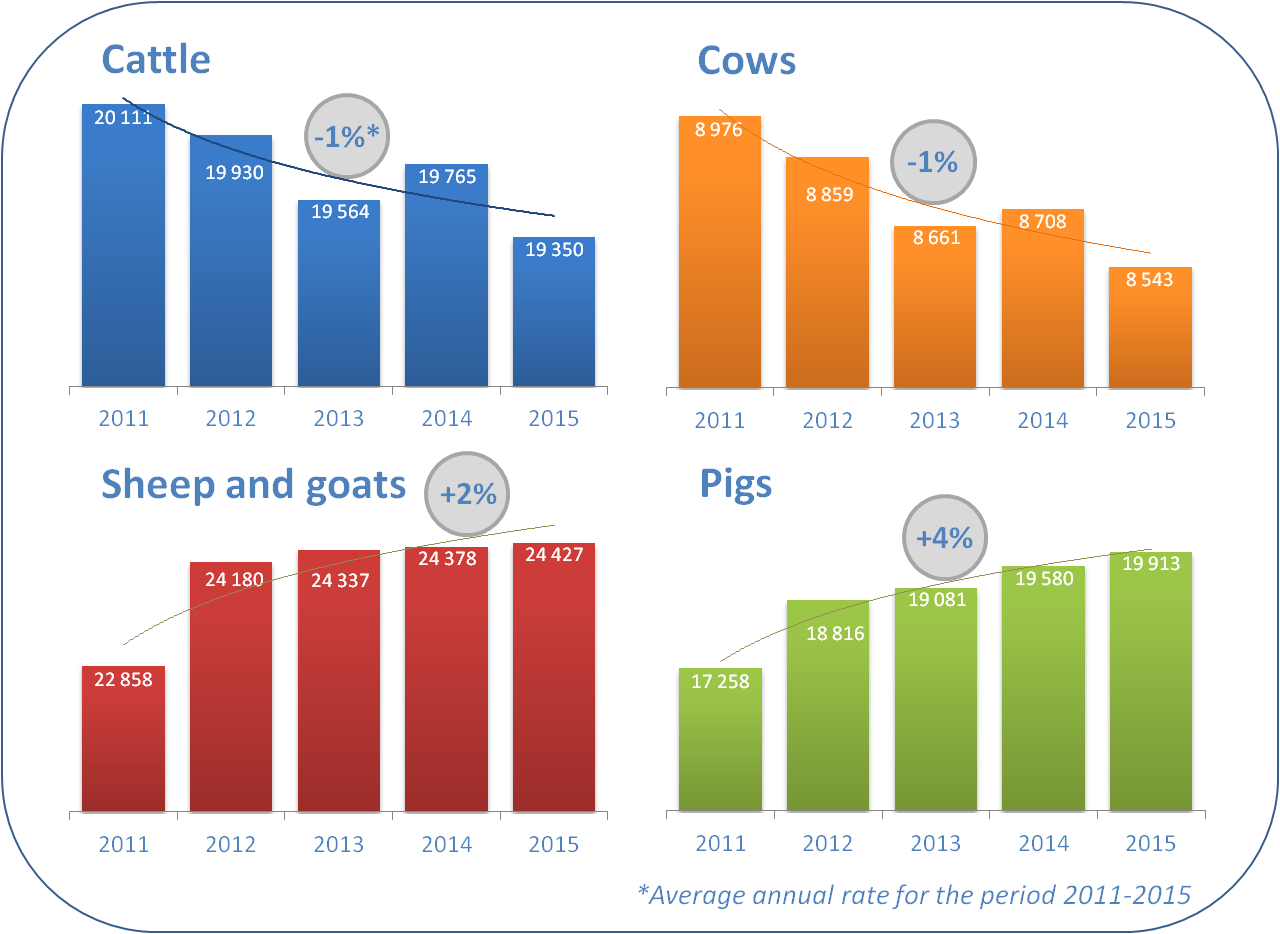

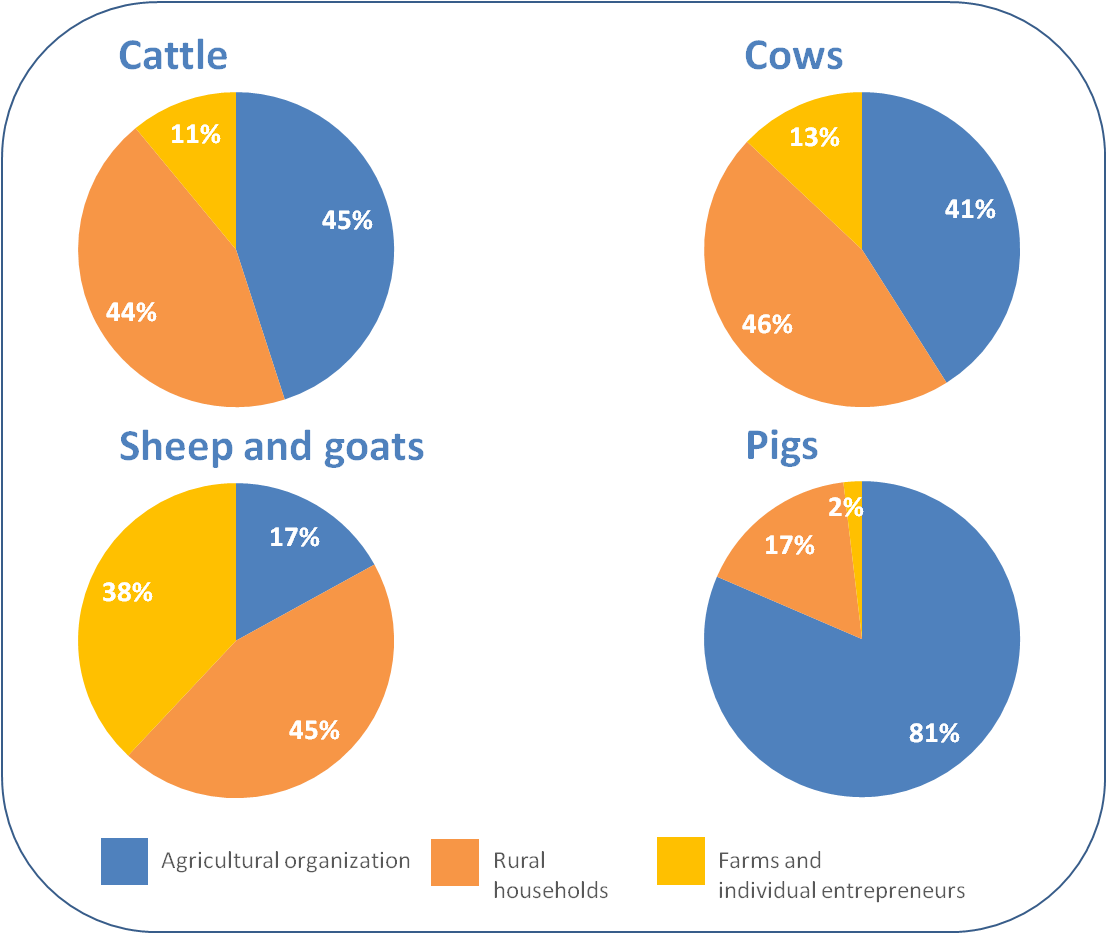

In agricultural organizations (excluding part-time farming) at the end of January 2015 the number of cattle reduced by 3.2%, cows - by 2,6%, sheep and goats - 1.3 % compared with the corresponding date in 2014. Also, compared with 2014, we can currently see a decline in the availability of livestock feed by an average of 6.4%.

Despite the fact that the farms household show increase in the number of livestock and the volume of production, anyway they will not improve the situation, because of less than 10% share in the total households amount. It is not specified in the "State program of agricultural development and regulation of agricultural products, raw materials and food for 2013-2020" how the livestock in each region will grow. Not knowing its performance, it is very difficult to make forecast and match an improvement in the further industry development.

Low agricultural subsidies in the country are one of the reasons for this sorry industry state. In the EU, they reach 40%, in Japan - 90%, significant subsidies to agriculture are presented in Belarus. The amount of subsidy per hectare in Russia on average is about 50 Euros, while in the EU average - 270 Euros in the Netherlands - 475 Euros. It is also necessary to note that the government appropriate funds to the regions under the terms and conditions of co-financing. In other words to get the money the region must grant its share to eventually scored the planned amount. In turn, the regions could simply not find the necessary amount of funds for co-financing of agricultural subsidies.

The low investment attractiveness of the industry should also be mentioned. Due to the general decline in the profitability of production, low environmental and personnel attraction and a number of other reasons, investors slow down to invest in agriculture, and it is difficult to imagine its development without it. The lack of logistical support and infrastructure development as a whole, imperfect customs and tariff regulation also counts for a great deal.

At the end of 2013 the Russian fishermen have increased fish capture by 1.2% to 4.135 million tons. In 2014, fishing occurred more rapidly than in the past – rates of increase were more than 4%. The international trade situation has been less encouraging. More than 40% of fish products imports fall to the share of countries under the sanctions (Norway, USA, Canada, etc.) And now there is a need to find a substitute. The most optimal and efficient replacement way will be the new suppliers from other countries searching than the increase in the share of domestic import substitution.

There are also several problems within the industry. The Russian tax legislation imperfection is the cause of the domestic fishery complex orientation for export (about 40% of the fish caught). The products supply to the domestic market needs to pay VAT, while during the export the vendor will get his money back. If the processor is going to buy fish from the enterprise taxable by the unified agricultural tax (UAT), the VAT will come upon the processor and that can drastically reduce its competitiveness. It is quite unprofitable for big investors to invest in fish processing, that`s why generally it is sold unprocessed. On this basis all over the place not paying taxes one-day firms arise.

The logistics issue still remains an important point, since more than 75% of the fishing takes place in the Far East while the main consumption is concentrated in the central regions. At the moment, on behalf of Federal Tariff Service widely discussed the size of subsidy tariffs for fish rail transportation.

The raw materials shortage, appearing in the market has a negative impact on the processing enterprises capacity utilization. At the same time, the high product quality is the primarily important thing for the consumer. The economic sanctions implementation may allow more actively solve the problems of fishery products producers in the matter of fish cultivation (for example, Norwegian companies) and its processing.

Today, the Russian dairy sector is characterized by a decrease in production volumes. This applies both to raw milk and dairy products. This is due primarily to the decline in livestock numbers and low quality of raw milk, the decrease in production facilities and the number of employees in the industry reduction. At the same time there is a slight average milk yield increase in the agricultural organizations. In January 2015 the average milk yield per cow was 451 kilograms against 420 kilograms in January 2014. With an average annual rate of 3.5-4 thousand kg of milk per 1 cow, these results are still extremely low.

The Ministry of Agriculture decree related to registration of veterinary accompanying documents provides multiple veterinary certifications during the batch lot production of animal origin, then after transport operations and in the transition of the controlled goods ownership. This order can significantly complicate the already difficult business development. Today, up to 50% of the companies are unable to provide electronic documentation traceability.

Many problems can cause and the electronic certification decree in 2015, as none of the companies has any experience in processing these documents. Such unavailability can lead to a partial production suspension and lack of goods for the consumer, and in the context of sanctions could end in milk and dairy products shortages.

Over the past few years in some segments of the crop, the consumption of which is increasing, there has been some drop in output. That is relating to the production of buckwheat, cucumbers, tomatoes, beets, onions and many other consumer products. This decline is due both to lower average yields, rising costs of production and thus a profit decrease, and also due to the foreign products competition, widely presented in the federal and regional retail chains.

Copyright © 2011 - All rights reserved - www.windsofchange.ru